Ethical Considerations in High-Risk Payment Processing: Balancing Profit and Responsibility

In the fast-paced world of high-risk payment processing, where financial transactions pulse through intricate networks, a crucial aspect often takes center stage: ethical considerations. Navigating this landscape demands a delicate balance between profitability and responsibility. As businesses strive to maximize gains, it becomes paramount to reflect on the ethical dimensions that underpin high-risk payment processing.

The Dynamic Nature of High-Risk Payment Processing

High-risk payment processing covers a spectrum of industries, from adult entertainment to gambling and, notably, tobacco. Tobacco Payment Processing is within the high-risk category that warrants special attention due to the unique challenges associated with the tobacco industry. Operating in an environment where public health concerns intersect with economic interests, tobacco payment processors must navigate a complex landscape shaped by varying international and local regulations. As stewards of financial transactions, payment processors must tread carefully through this dynamic environment, acknowledging the potential social and health impacts associated with the services they facilitate.

Transparency and Consumer Trust

One cornerstone of ethical high-risk payment processing is transparency. Businesses need to provide clear and comprehensive information about their services, ensuring that both merchants and consumers are fully aware of the associated risks. Establishing trust is pivotal in fostering long-term relationships, and ethical conduct is a key building block in this process.

Adherence to Legal and Regulatory Frameworks

Operating ethically in high-risk payment processing requires strict adherence to legal and regulatory frameworks. Industries such as gambling and tobacco are subject to evolving rules, necessitating continuous monitoring and adaptation. Ethical processors stay ahead of the curve, proactively adjusting their operations to align with the latest standards, thus mitigating potential legal pitfalls.

Social Responsibility in Tobacco Payment Processing

Specifically, in the realm of tobacco payment processing, social responsibility is a critical consideration. Acknowledging the health risks associated with tobacco use, processors in this domain must assess the broader impact of their services. Some may choose to adopt measures to discourage underage access, while others may contribute to public health initiatives. The commitment to ethical conduct extends beyond financial transactions to a genuine effort to minimize harm and contribute positively to society.

Equilibrium Between Profit and Responsibility

Finding the equilibrium between profit and responsibility is a continuous challenge. Ethical high-risk payment processors understand that sustainable success is not achieved at the expense of societal well-being. Initiatives that support responsible gambling, discourage underage tobacco sales, and contribute to community welfare demonstrate a commitment to balancing financial goals with ethical imperatives.

In Conclusion

In the complex world of high-risk payment processing, ethical considerations serve as the guiding compass for responsible and sustainable operations. By prioritizing transparency, adhering to legal standards, and embracing social responsibility, payment processors can not only secure their place in the market but also contribute to a more conscientious and ethical financial ecosystem. As technology continues to evolve, so too must our commitment to ethical conduct, ensuring that profitability is achieved hand in hand with a sense of responsibility and accountability.…

One of the primary reasons behind the perception of silver underperformance is its inherent price volatility. Silver prices are influenced by a multitude of factors, including economic indicators, geopolitical events, and fluctuations in currency values. This volatility can make silver a challenging asset to predict and invest in, leading some investors to perceive it as underperforming, especially when compared to more stable assets.

One of the primary reasons behind the perception of silver underperformance is its inherent price volatility. Silver prices are influenced by a multitude of factors, including economic indicators, geopolitical events, and fluctuations in currency values. This volatility can make silver a challenging asset to predict and invest in, leading some investors to perceive it as underperforming, especially when compared to more stable assets. Conspiracy theories and concerns about market manipulation have circulated in the precious metals market. Some investors believe that silver prices are suppressed artificially, preventing the metal from realizing its true market potential. While these claims lack substantial evidence, the perception of market manipulation can contribute to the belief that silver is underperforming relative to its intrinsic value.

Conspiracy theories and concerns about market manipulation have circulated in the precious metals market. Some investors believe that silver prices are suppressed artificially, preventing the metal from realizing its true market potential. While these claims lack substantial evidence, the perception of market manipulation can contribute to the belief that silver is underperforming relative to its intrinsic value.

Research and staying informed are key to navigating the world of silver investments successfully. Take the time to understand the current market trends, historical price movements, and factors that can influence silver prices. Stay updated on news related to global economies, political events, and any other macroeconomic factors that may impact the precious metals market. One way to stay informed is by following reputable financial news outlets or subscribing to newsletters from trusted experts in the field. These sources can provide valuable insights into market conditions and offer expert analysis on silver investment opportunities. Additionally, it’s crucial to educate yourself about different forms of silver investments.

Research and staying informed are key to navigating the world of silver investments successfully. Take the time to understand the current market trends, historical price movements, and factors that can influence silver prices. Stay updated on news related to global economies, political events, and any other macroeconomic factors that may impact the precious metals market. One way to stay informed is by following reputable financial news outlets or subscribing to newsletters from trusted experts in the field. These sources can provide valuable insights into market conditions and offer expert analysis on silver investment opportunities. Additionally, it’s crucial to educate yourself about different forms of silver investments.

Real estate has long been considered a solid investment choice and continues to hold its ground as an effective inflation hedge. Property investment can provide income through rental payments and potential appreciation over time. Whether you opt for residential or commercial real estate, choosing locations with strong growth prospects is key. One advantage of investing in real estate is the ability to generate passive income.

Real estate has long been considered a solid investment choice and continues to hold its ground as an effective inflation hedge. Property investment can provide income through rental payments and potential appreciation over time. Whether you opt for residential or commercial real estate, choosing locations with strong growth prospects is key. One advantage of investing in real estate is the ability to generate passive income. Cryptocurrencies have become a hot topic in recent years, with Bitcoin’s meteoric rise capturing the attention of investors worldwide. But what exactly are cryptocurrencies, and how can they serve as an inflation hedge investment? At their core, cryptocurrencies are digital or virtual currencies that use cryptography for security.

Cryptocurrencies have become a hot topic in recent years, with Bitcoin’s meteoric rise capturing the attention of investors worldwide. But what exactly are cryptocurrencies, and how can they serve as an inflation hedge investment? At their core, cryptocurrencies are digital or virtual currencies that use cryptography for security.

In today’s digital age, cybersecurity protection has become increasingly crucial for businesses, including casinos. With the constant threat of cyber-attacks and data breaches, casinos need robust measures to safeguard their sensitive information and ensure a secure gaming environment for their customers.

In today’s digital age, cybersecurity protection has become increasingly crucial for businesses, including casinos. With the constant threat of cyber-attacks and data breaches, casinos need robust measures to safeguard their sensitive information and ensure a secure gaming environment for their customers.

Harness the power of automation to streamline your saving and investing efforts. Set up automatic transfers from your paycheck to a separate savings account or investment vehicle. By making saving a habit, you’ll effortlessly accumulate wealth over time.

Harness the power of automation to streamline your saving and investing efforts. Set up automatic transfers from your paycheck to a separate savings account or investment vehicle. By making saving a habit, you’ll effortlessly accumulate wealth over time. One of the most valuable assets you possess is yourself. Invest in personal and professional growth to expand your earning potential. Attend seminars, take courses, read books, and learn from successful individuals in your field. Continuous learning opens doors to new opportunities and enhances your financial prospects.

One of the most valuable assets you possess is yourself. Invest in personal and professional growth to expand your earning potential. Attend seminars, take courses, read books, and learn from successful individuals in your field. Continuous learning opens doors to new opportunities and enhances your financial prospects.

There are many reasons to get health insurance. The most important reason is that it can save money on medical bills. If you have health insurance, your insurance company will help pay for some or all of your medical expenses. This can help you avoid financial ruin if you face a major medical crisis.Another reason to get health insurance is that it can give you peace of mind.

There are many reasons to get health insurance. The most important reason is that it can save money on medical bills. If you have health insurance, your insurance company will help pay for some or all of your medical expenses. This can help you avoid financial ruin if you face a major medical crisis.Another reason to get health insurance is that it can give you peace of mind. There are a few things to consider when choosing a healthcare plan. First, you need to decide whether you want a traditional or high-deductible health insurance plan. A standard health insurance plan will have lower monthly premiums but higher out-of-pocket costs when you need medical care. A high-deductible health insurance plan will have higher monthly premiums but lower out-of-pocket costs when you need medical care.

There are a few things to consider when choosing a healthcare plan. First, you need to decide whether you want a traditional or high-deductible health insurance plan. A standard health insurance plan will have lower monthly premiums but higher out-of-pocket costs when you need medical care. A high-deductible health insurance plan will have higher monthly premiums but lower out-of-pocket costs when you need medical care.

Lastly, gold is a very liquid asset that can be easily converted into cash if needed. This makes gold ideal for providing emergency funds or giving you more flexibility with your retirement portfolio. You don’t need to worry about being stuck with an illiquid asset if you ever need to access some of your savings quickly. A gold IRA can be an excellent addition to any retirement portfolio.

Lastly, gold is a very liquid asset that can be easily converted into cash if needed. This makes gold ideal for providing emergency funds or giving you more flexibility with your retirement portfolio. You don’t need to worry about being stuck with an illiquid asset if you ever need to access some of your savings quickly. A gold IRA can be an excellent addition to any retirement portfolio.

If you are struggling to deal with mortgage delinquency, it is vital to seek help as soon as possible. Several organizations can provide assistance, such as non-profit housing counseling agencies, legal aid organizations, and government agencies. These organizations can provide advice, guidance, and support to help you navigate the process of dealing with mortgage delinquency and protect your home.

If you are struggling to deal with mortgage delinquency, it is vital to seek help as soon as possible. Several organizations can provide assistance, such as non-profit housing counseling agencies, legal aid organizations, and government agencies. These organizations can provide advice, guidance, and support to help you navigate the process of dealing with mortgage delinquency and protect your home.

The first way to save

The first way to save  The fourth way to save money for your dream car is to get a side hustle. Look for ways to make extra income, whether freelancing or picking up odd jobs. Any extra funds can go straight into your savings goal for the car of your dreams. If you have a day job, try finding a side hustle that you can do in your free time, such as dog walking or tutoring. This is a great way to bring in some extra cash and achieve your dream car goal. Many people have done this to afford their dream car, so don’t be afraid to try it out. Saving up for your dream car doesn’t have to be a daunting task.

The fourth way to save money for your dream car is to get a side hustle. Look for ways to make extra income, whether freelancing or picking up odd jobs. Any extra funds can go straight into your savings goal for the car of your dreams. If you have a day job, try finding a side hustle that you can do in your free time, such as dog walking or tutoring. This is a great way to bring in some extra cash and achieve your dream car goal. Many people have done this to afford their dream car, so don’t be afraid to try it out. Saving up for your dream car doesn’t have to be a daunting task.

A hedge fund is a type of investment fund that uses leverage and derivatives to generate returns. Hedge funds are typically only available to accredited investors. It’s imperative to know the difference between an accredited investor and a non-accredited investor before investing in a hedge fund, so make sure you do your research. As you can see, there are a number of different types of investors out there. Each type of investor plays a different role in the economy and has a different risk tolerance. It’s vital for us to understand these different types of investors so that we can make informed decisions about our own investments.…

A hedge fund is a type of investment fund that uses leverage and derivatives to generate returns. Hedge funds are typically only available to accredited investors. It’s imperative to know the difference between an accredited investor and a non-accredited investor before investing in a hedge fund, so make sure you do your research. As you can see, there are a number of different types of investors out there. Each type of investor plays a different role in the economy and has a different risk tolerance. It’s vital for us to understand these different types of investors so that we can make informed decisions about our own investments.…

The first step in buying a new car is determining your budget. This entails examining your financial situation and evaluating how much you can afford to spend on a vehicle. Keep in mind that you’ll have to account for the car’s purchase price and costs such as insurance, gas, and maintenance. You may begin shopping for the greatest offer once you have a decent notion of your budget. Negotiating with dealers is one strategy to save money when buying a new car. If you’re not used to negotiating, you can do a few things to prepare.

The first step in buying a new car is determining your budget. This entails examining your financial situation and evaluating how much you can afford to spend on a vehicle. Keep in mind that you’ll have to account for the car’s purchase price and costs such as insurance, gas, and maintenance. You may begin shopping for the greatest offer once you have a decent notion of your budget. Negotiating with dealers is one strategy to save money when buying a new car. If you’re not used to negotiating, you can do a few things to prepare. The total cost of ownership (TCO) is the true measure of what a car will cost you. It encompasses the purchase price and monthly payments and insurance, gas, maintenance, repairs, and depreciation. Use online TCO calculators to compare the long-term costs of different vehicles before making your decision. This way, you can be sure you’re getting the best deal.

The total cost of ownership (TCO) is the true measure of what a car will cost you. It encompasses the purchase price and monthly payments and insurance, gas, maintenance, repairs, and depreciation. Use online TCO calculators to compare the long-term costs of different vehicles before making your decision. This way, you can be sure you’re getting the best deal.

If you have high-interest debts, such as credit card debt, a personal loan can be an excellent way to pay off those debts. Personal loans usually have lower interest rates than credit cards, so you’ll save money on interest payments. Plus, by consolidating your debts into one monthly payment, you’ll be able to get out of debt more quickly. Just be sure to shop around for the best personal loan rates and terms before applying.

If you have high-interest debts, such as credit card debt, a personal loan can be an excellent way to pay off those debts. Personal loans usually have lower interest rates than credit cards, so you’ll save money on interest payments. Plus, by consolidating your debts into one monthly payment, you’ll be able to get out of debt more quickly. Just be sure to shop around for the best personal loan rates and terms before applying. If you have bad credit, a personal loan can be an excellent way to improve your credit score. By making on-time payments each month, you’ll build up your credit history and improve your credit score. Just be sure to shop around for the best personal loan rates and terms before applying. Also, make sure that you only borrow as much as you can afford to repay. Personal loans can be a great way to get your finances in order. Just be sure to shop around for the best personal loan rates and terms and only borrow as much as you can afford to repay. Personal loans can also be a huge financial mistake if you’re not careful.…

If you have bad credit, a personal loan can be an excellent way to improve your credit score. By making on-time payments each month, you’ll build up your credit history and improve your credit score. Just be sure to shop around for the best personal loan rates and terms before applying. Also, make sure that you only borrow as much as you can afford to repay. Personal loans can be a great way to get your finances in order. Just be sure to shop around for the best personal loan rates and terms and only borrow as much as you can afford to repay. Personal loans can also be a huge financial mistake if you’re not careful.…

Investing is the act of committing money to an endeavor with the expectation of earning a financial return. In short, you’re giving someone else your money in the hopes that they will use it to create more money. This could be through buying stocks, investing in a business, or anything else that has the potential to make more money than you put in.

Investing is the act of committing money to an endeavor with the expectation of earning a financial return. In short, you’re giving someone else your money in the hopes that they will use it to create more money. This could be through buying stocks, investing in a business, or anything else that has the potential to make more money than you put in.

According to a recent study, over 25% of people in the UK have unpaid bills. This can be a major problem because it can lead to late fees, disconnection of services, and even legal action. If you are having trouble paying your bills, you can do a few things. First, try to work out a payment plan with your creditors. This can help you avoid late fees and keep your service-connected. Second, try to find a way to increase your income. This may mean getting a second job or finding ways to make money online.

According to a recent study, over 25% of people in the UK have unpaid bills. This can be a major problem because it can lead to late fees, disconnection of services, and even legal action. If you are having trouble paying your bills, you can do a few things. First, try to work out a payment plan with your creditors. This can help you avoid late fees and keep your service-connected. Second, try to find a way to increase your income. This may mean getting a second job or finding ways to make money online. Foreclosure is the legal process where your lender takes back possession of your home because you have not kept up with your mortgage repayments. If you face foreclosure, you will receive a notice from your lender stating their intention to take your home back. You will then have a certain period, typically around two months, to bring your mortgage up to date. If you are unable to do this, your lender will begin the process of taking back your home and selling it at auction.

Foreclosure is the legal process where your lender takes back possession of your home because you have not kept up with your mortgage repayments. If you face foreclosure, you will receive a notice from your lender stating their intention to take your home back. You will then have a certain period, typically around two months, to bring your mortgage up to date. If you are unable to do this, your lender will begin the process of taking back your home and selling it at auction.

If you’re looking to get ahead financially, one of the best things you can do is negotiate a higher salary at your next job interview. This means asking for more money than what’s been offered to you. It may be intimidating, but it’s worth trying! By negotiating a higher salary, you’ll be in a better position to achieve your financial goals.

If you’re looking to get ahead financially, one of the best things you can do is negotiate a higher salary at your next job interview. This means asking for more money than what’s been offered to you. It may be intimidating, but it’s worth trying! By negotiating a higher salary, you’ll be in a better position to achieve your financial goals.

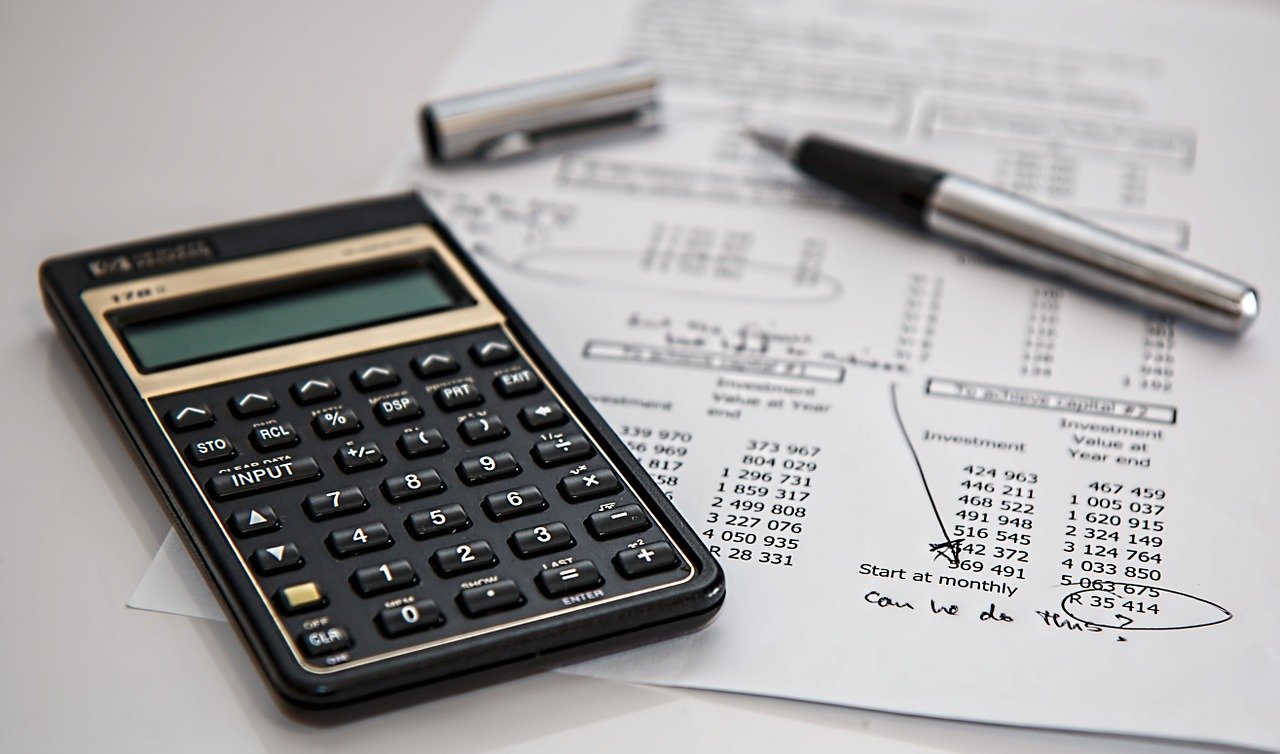

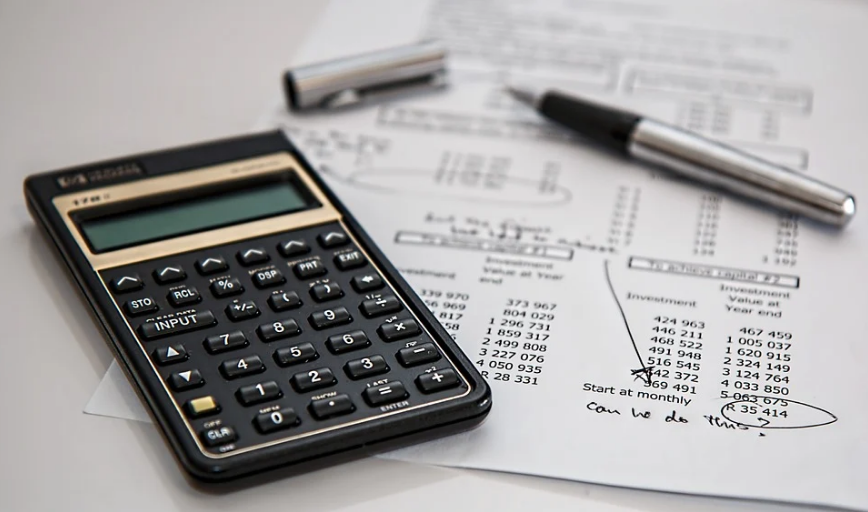

One of the main benefits of working with a financial advisor is that they can help you create a realistic budget. A financial advisor will work with you to figure out your income and expenses and then create a budget that fits your needs. They can also help you stick to your budget by giving you tips and advice on saving money. Many people find that having a budget helps them stay on track financially and avoid debt.

One of the main benefits of working with a financial advisor is that they can help you create a realistic budget. A financial advisor will work with you to figure out your income and expenses and then create a budget that fits your needs. They can also help you stick to your budget by giving you tips and advice on saving money. Many people find that having a budget helps them stay on track financially and avoid debt. In addition to helping you plan for retirement, a financial advisor can also help you invest your money in the right places. They know which investments are best for different situations, and they can help you find investments that will give you the highest return on investment. They can also advise you on when to buy and sell stocks to avoid losing any money. Many people have lost a lot of money due to wrong investments.

In addition to helping you plan for retirement, a financial advisor can also help you invest your money in the right places. They know which investments are best for different situations, and they can help you find investments that will give you the highest return on investment. They can also advise you on when to buy and sell stocks to avoid losing any money. Many people have lost a lot of money due to wrong investments.

There are many mobile apps that you can use to track your cryptocurrency portfolio’s performance. Some examples include Delta Crypto Portfolio Tracker, CoinCap, and BlockFolio. BlockFolio is also available for desktop browsers, so it’s easy to check up on where all your investments stand while at work or school. It’s easy to get caught up in trying out different cryptocurrencies, but it’s also imperative that you understand what each one can do for you.

There are many mobile apps that you can use to track your cryptocurrency portfolio’s performance. Some examples include Delta Crypto Portfolio Tracker, CoinCap, and BlockFolio. BlockFolio is also available for desktop browsers, so it’s easy to check up on where all your investments stand while at work or school. It’s easy to get caught up in trying out different cryptocurrencies, but it’s also imperative that you understand what each one can do for you. One of the most important things to consider when looking at a new cryptocurrency is whether or not you have an exit plan. And if so, what will that plan be? What would cause you to pull out all your money and move it into another currency? If your goal was just short-term gains, this might not be as big of an issue, but if you are looking to build long-term wealth, it can help to have a plan in place. You may want to consider having two different portfolios: short-term gains and long-term investments. This way, all your coins won’t automatically go towards the first coin that does well.…

One of the most important things to consider when looking at a new cryptocurrency is whether or not you have an exit plan. And if so, what will that plan be? What would cause you to pull out all your money and move it into another currency? If your goal was just short-term gains, this might not be as big of an issue, but if you are looking to build long-term wealth, it can help to have a plan in place. You may want to consider having two different portfolios: short-term gains and long-term investments. This way, all your coins won’t automatically go towards the first coin that does well.…

An emergency loan is a short-term, high-interest loan that you can use for any financial need. It’s essential to understand how these loans work before signing up because the repayment terms are often different from standard personal loans.

An emergency loan is a short-term, high-interest loan that you can use for any financial need. It’s essential to understand how these loans work before signing up because the repayment terms are often different from standard personal loans. Although emergency loans can be a helpful financial resource, they’re not suitable for everyone. One downside of these loans is that the interest rates and fees. This means that you could end up paying a lot of money back in addition to the amount you borrowed. Another potential drawback of emergency loans is that the repayment terms can be very strict. If you miss a payment, the lender can take extra fees out of your bank account or charge additional interest on top of what’s already due.

Although emergency loans can be a helpful financial resource, they’re not suitable for everyone. One downside of these loans is that the interest rates and fees. This means that you could end up paying a lot of money back in addition to the amount you borrowed. Another potential drawback of emergency loans is that the repayment terms can be very strict. If you miss a payment, the lender can take extra fees out of your bank account or charge additional interest on top of what’s already due.

As there are many gold IRA companies in the United States and even more outside of it, it is essential to know where each company is located. Some people may not know that location is vital in ensuring that they are invested in a stable country. This is why it is important to research where the company you choose invests their clients’ money. Moving your gold investments overseas can be beneficial because many countries have unstable currencies and high inflation rates, which makes investing abroad more profitable than within domestic borders.

As there are many gold IRA companies in the United States and even more outside of it, it is essential to know where each company is located. Some people may not know that location is vital in ensuring that they are invested in a stable country. This is why it is important to research where the company you choose invests their clients’ money. Moving your gold investments overseas can be beneficial because many countries have unstable currencies and high inflation rates, which makes investing abroad more profitable than within domestic borders.

The government has many useful plans to help Americans get health insurance coverage. One of these is the grant. In simple terms, a subsidy is a payment from the government to insurance companies to provide affordable health insurance to people with low incomes. Subsidies allow people who fall into the low-income category to get health insurance coverage.

The government has many useful plans to help Americans get health insurance coverage. One of these is the grant. In simple terms, a subsidy is a payment from the government to insurance companies to provide affordable health insurance to people with low incomes. Subsidies allow people who fall into the low-income category to get health insurance coverage. Before you pick up your copy best Affordable Health Insurance it’s important to know which policy best suits your needs. Here is a brief summary of the two options available to help you choose the right policy.

Before you pick up your copy best Affordable Health Insurance it’s important to know which policy best suits your needs. Here is a brief summary of the two options available to help you choose the right policy.

A construction bond is a name given to a surety bond designed to come into usage by shareholders in jobs associated with building and construction. This measure has largely been taken to offer a particular sort of protection from a severe event. The rationale for it being the bankruptcy of the contractors or the inefficiency of this job to fulfill ends with all the specifications of this contract. Usually, you’ll observe the presence of three types of parties in a

A construction bond is a name given to a surety bond designed to come into usage by shareholders in jobs associated with building and construction. This measure has largely been taken to offer a particular sort of protection from a severe event. The rationale for it being the bankruptcy of the contractors or the inefficiency of this job to fulfill ends with all the specifications of this contract. Usually, you’ll observe the presence of three types of parties in a  This performance bond is used to supply a type of assurance or assurance by the builder or the main. If the key is regarded as confronting defaults under any conditions, the proprietor retains the best of calling on the surety to ensure that the contractor fulfills its conclusion.

This performance bond is used to supply a type of assurance or assurance by the builder or the main. If the key is regarded as confronting defaults under any conditions, the proprietor retains the best of calling on the surety to ensure that the contractor fulfills its conclusion.

Most of your debt will accumulate interest over time, and the longer you don’t pay off your debt, the more you’ll have to pay in the long run. By taking control of your finances, you can gradually reduce your debt and thus reduce the total amount of interest you have to pay. Also, when you pay off your debt, your credit score will improve over time, making it easier to get financing for a vehicle, business, or home.

Most of your debt will accumulate interest over time, and the longer you don’t pay off your debt, the more you’ll have to pay in the long run. By taking control of your finances, you can gradually reduce your debt and thus reduce the total amount of interest you have to pay. Also, when you pay off your debt, your credit score will improve over time, making it easier to get financing for a vehicle, business, or home. If you owe a lot of money or have to file for bankruptcy, there is a fantastic chance that they will come to liquidate your assets. You’ve worked hard to produce these items, and the consequence that liquidation of assets has on your debts generally reflects only a small percentage of the actual price of the asset. Protecting your assets should be a top priority. It would be a shame to have your valuables taken away just because you have a small amount of debt. By establishing financing and taking responsibility for your finances, you can prevent this from happening or mitigate your losses.

If you owe a lot of money or have to file for bankruptcy, there is a fantastic chance that they will come to liquidate your assets. You’ve worked hard to produce these items, and the consequence that liquidation of assets has on your debts generally reflects only a small percentage of the actual price of the asset. Protecting your assets should be a top priority. It would be a shame to have your valuables taken away just because you have a small amount of debt. By establishing financing and taking responsibility for your finances, you can prevent this from happening or mitigate your losses. You can choose to trade stocks, bonds, or securities to make your wealth growth a reality, or you can invest in instruments that allow you to earn more from your trading. The freedom to invest in your future is one of the best feelings, and with a full budget, you will be better prepared to invest on your own. Even if you only invest a small amount each month, the accumulated profits from your investments will add up and put you in a much better financial position over time. Besides, …

You can choose to trade stocks, bonds, or securities to make your wealth growth a reality, or you can invest in instruments that allow you to earn more from your trading. The freedom to invest in your future is one of the best feelings, and with a full budget, you will be better prepared to invest on your own. Even if you only invest a small amount each month, the accumulated profits from your investments will add up and put you in a much better financial position over time. Besides, …

If you want to refinance a title loan, as with any other loan, you should be sure to read and understand the acceptable print implications in the loan documents. If you accept the balloon payment and refinance in three years, make sure you know this initially, not after the paperwork is signed, or worse, when the balloon payment is due. It is essential to look at the entire package. Another lender will require additional points or closing costs to get the loan.

If you want to refinance a title loan, as with any other loan, you should be sure to read and understand the acceptable print implications in the loan documents. If you accept the balloon payment and refinance in three years, make sure you know this initially, not after the paperwork is signed, or worse, when the balloon payment is due. It is essential to look at the entire package. Another lender will require additional points or closing costs to get the loan.

A common perception among customers is that

A common perception among customers is that

FHA was set in 1934 to improve

FHA was set in 1934 to improve

If you borrow money from a creditor, you must return it with interest. Here is the money the lender makes to support you. In installment loans for people with bad credit, their interest rate is higher than normal. This is simply because you are considered an unsafe customer. This is all the more reason to borrow exactly what you want. Also, you also need to compare the offers of credit institutions so that you can find the money you need at the lowest interest rate. Start looking for lenders who will not find you if you pay more than you should. If you receive some excess money or have the option of making double payments, you need to do so, preferably without being charged.

If you borrow money from a creditor, you must return it with interest. Here is the money the lender makes to support you. In installment loans for people with bad credit, their interest rate is higher than normal. This is simply because you are considered an unsafe customer. This is all the more reason to borrow exactly what you want. Also, you also need to compare the offers of credit institutions so that you can find the money you need at the lowest interest rate. Start looking for lenders who will not find you if you pay more than you should. If you receive some excess money or have the option of making double payments, you need to do so, preferably without being charged.

Traditionally, trading was defined as a risky approach, as places are often bought and held since traders set a particular period beforehand. This swing dealer aims to observe the downward or upward tendency and put his trades in the most favorable place. From that point, the dealer will ride the path towards whatever he selects as a paralysis stage and the marketplace to create a profit.

Traditionally, trading was defined as a risky approach, as places are often bought and held since traders set a particular period beforehand. This swing dealer aims to observe the downward or upward tendency and put his trades in the most favorable place. From that point, the dealer will ride the path towards whatever he selects as a paralysis stage and the marketplace to create a profit. The overall theme is that traders’ goal must be to optimize their likelihood of success by restricting or eliminating risks. Malicious price activities coldly prevent a reluctant trader in his paths since there’s no prevailing tendency from which they may be decoupled. When appropriately used, swing trading is a superb strategy utilized by numerous dealers in various markets and different.

The overall theme is that traders’ goal must be to optimize their likelihood of success by restricting or eliminating risks. Malicious price activities coldly prevent a reluctant trader in his paths since there’s no prevailing tendency from which they may be decoupled. When appropriately used, swing trading is a superb strategy utilized by numerous dealers in various markets and different.

One of the advantages of investing in gold is that it is almost universally recognized as a valuable store and is often used for jewelry. The most significant disadvantage of gold is that the price per gram or ounce becomes high. And investing in gold brings a problem when investing in almost all metal goods. You release your money into a fund that you cannot use in specific scenarios. In various situations, you want to exchange in a critical reduction exchanging gold jewelry to get a basket of food, since that is all you want to exchange.

One of the advantages of investing in gold is that it is almost universally recognized as a valuable store and is often used for jewelry. The most significant disadvantage of gold is that the price per gram or ounce becomes high. And investing in gold brings a problem when investing in almost all metal goods. You release your money into a fund that you cannot use in specific scenarios. In various situations, you want to exchange in a critical reduction exchanging gold jewelry to get a basket of food, since that is all you want to exchange.

Expenses are part and parcel of each organization, no matter whether it’s offline or online. However, online companies may have lesser operating costs than their offline counterpart. For instance, online businesses will save the cash needed

Expenses are part and parcel of each organization, no matter whether it’s offline or online. However, online companies may have lesser operating costs than their offline counterpart. For instance, online businesses will save the cash needed  A startup business should balance between getting the tasks done in house and outsourcing. Getting the work done in-house ensures you will need to keep up a group of employees who are given jobs continuously to ensure their productivity is equal or greater than what’s being spent on these. On the flip side, taking freelancers’ help is much better as you aren’t dedicated to them on a philosophical foundation.

A startup business should balance between getting the tasks done in house and outsourcing. Getting the work done in-house ensures you will need to keep up a group of employees who are given jobs continuously to ensure their productivity is equal or greater than what’s being spent on these. On the flip side, taking freelancers’ help is much better as you aren’t dedicated to them on a philosophical foundation.

The interest rate on personal cash loans is normally evaluated as interest-only payments. This means that a private money borrower must pay attention after each month throughout the extended loan duration and make the whole repayment once the loan ends. A few creditors will also be responsible for charging the prepayment penalties.

The interest rate on personal cash loans is normally evaluated as interest-only payments. This means that a private money borrower must pay attention after each month throughout the extended loan duration and make the whole repayment once the loan ends. A few creditors will also be responsible for charging the prepayment penalties.

People residing on the second floor or greater have a greater propensity to be responsible for property damage to acquaintances, considering individuals are directly under. Waterbeds can ruin your own life; prepare yourself to pay the damage of these residing when it rises. Have you got a dog? If that’s the case, insurance protects if its testosterone is released by the animal in visitors or your neighbors. Be careful if there are kids. People that have regular visitors are inclined to possess a non-inhabitant to incur some form of injury. Careful. When a friend gets litigious, never know. It is an automatic trigger. Should you think your home to be a higher risk. Otherwise, dig and let us examine the worth of reduction and your premises.

People residing on the second floor or greater have a greater propensity to be responsible for property damage to acquaintances, considering individuals are directly under. Waterbeds can ruin your own life; prepare yourself to pay the damage of these residing when it rises. Have you got a dog? If that’s the case, insurance protects if its testosterone is released by the animal in visitors or your neighbors. Be careful if there are kids. People that have regular visitors are inclined to possess a non-inhabitant to incur some form of injury. Careful. When a friend gets litigious, never know. It is an automatic trigger. Should you think your home to be a higher risk. Otherwise, dig and let us examine the worth of reduction and your premises. “Steal-able” possessions are things likely and accessible to be stolen from the case of burglary: TVs, DVD players, jewelry, computers, or even money typically stored available, among other things. This will be to assess the damage in the case since it’s uncommon that possessions are missing, you’re the victim of burglary. Entire properties comprise everything from your shoes all of the way to your hair drier. Estimates are as said quotes. Imagine dropping everything and think about the costs of obtaining it all back again. This is vital to assess your reduction in case of a catastrophe like fire in.

“Steal-able” possessions are things likely and accessible to be stolen from the case of burglary: TVs, DVD players, jewelry, computers, or even money typically stored available, among other things. This will be to assess the damage in the case since it’s uncommon that possessions are missing, you’re the victim of burglary. Entire properties comprise everything from your shoes all of the way to your hair drier. Estimates are as said quotes. Imagine dropping everything and think about the costs of obtaining it all back again. This is vital to assess your reduction in case of a catastrophe like fire in.

As

As  There is an adage: When college teachers and janitors begin making millions of costs will crash since we need janitors and faculty teachers. When its citizens start losing money or earning a great deal of cash without paying, the authorities worry. There is no denying that India and South Korea are among the nations on the exchanges. Nevertheless, both authorities are thinking about prohibiting bitcoin trading. The US world Bitcoin participant is currently working on choosing how to control the marketplace. Until this moment, the prices of other along with Bitcoin crypto-currencies will stay volatile. The cost increases due to needing but will fall every time. Individuals should concentrate on a single rule of investment until prices stabilize. Never spend money you could afford to lose. Bitcoin is currently hitting its crossroads.

There is an adage: When college teachers and janitors begin making millions of costs will crash since we need janitors and faculty teachers. When its citizens start losing money or earning a great deal of cash without paying, the authorities worry. There is no denying that India and South Korea are among the nations on the exchanges. Nevertheless, both authorities are thinking about prohibiting bitcoin trading. The US world Bitcoin participant is currently working on choosing how to control the marketplace. Until this moment, the prices of other along with Bitcoin crypto-currencies will stay volatile. The cost increases due to needing but will fall every time. Individuals should concentrate on a single rule of investment until prices stabilize. Never spend money you could afford to lose. Bitcoin is currently hitting its crossroads.

You Must Leave Some Inheritance to Your Spouse and Children

You Must Leave Some Inheritance to Your Spouse and Children

Common Tax Returns Forms

Common Tax Returns Forms

An independent insurance agent is a representative of many insurance companies which offer a variety of car coverage options. Therefore, when you choose to seek insurance assistance from the independent agent, the individual will provide you with a variety of options to choose from. You will not be limited to single coverage. The agent will make your work easier by breaking down the quotations of different insurance companies rather than doing it a by yourself. With the connection and knowledge of the insurance sector that the agent has, the individual will know the best deal that will suit you and offer value for your money.

An independent insurance agent is a representative of many insurance companies which offer a variety of car coverage options. Therefore, when you choose to seek insurance assistance from the independent agent, the individual will provide you with a variety of options to choose from. You will not be limited to single coverage. The agent will make your work easier by breaking down the quotations of different insurance companies rather than doing it a by yourself. With the connection and knowledge of the insurance sector that the agent has, the individual will know the best deal that will suit you and offer value for your money. The car insurance agent will not only help you find the best pricing on insurance but will also ensure you get covered adequately. Since you will be interacting with the agent more often. The agent will become your adviser and make time to listen to you and know your needs in details. The agent will ensure that you don’t only get an insurance cover that is affordable but also one that will cover your car appropriately. The cover that the agent will offer you will be one that will see you pick up your pieces after a tragedy.

The car insurance agent will not only help you find the best pricing on insurance but will also ensure you get covered adequately. Since you will be interacting with the agent more often. The agent will become your adviser and make time to listen to you and know your needs in details. The agent will ensure that you don’t only get an insurance cover that is affordable but also one that will cover your car appropriately. The cover that the agent will offer you will be one that will see you pick up your pieces after a tragedy.

The first thing to consider before starting a science business is to ask you if it is viable. When it comes to a science business, you need to ask yourself if the business can solve the problem. The primary role of science is to address the issues and improve our way of living.

The first thing to consider before starting a science business is to ask you if it is viable. When it comes to a science business, you need to ask yourself if the business can solve the problem. The primary role of science is to address the issues and improve our way of living. When setting a science business, you might want to look for an investment consultant. The role of an investor consultant is to help you with the business aspect of your science innovation. You need to look for a way to make the model generate money for you. A science-business is only useful if it can help you to create cash. You need to create enough money to sustain daily operations and also get profits.

When setting a science business, you might want to look for an investment consultant. The role of an investor consultant is to help you with the business aspect of your science innovation. You need to look for a way to make the model generate money for you. A science-business is only useful if it can help you to create cash. You need to create enough money to sustain daily operations and also get profits.